编者按:本文来自微信公众号易则投资(ID:yizefund)翻译,原文作者:James Anderson,创业邦经授权转载

引言

詹姆斯•安德森(James Anderson)是Baillie Gifford的合伙人之一,也是该公司的旗舰基金苏格兰抵押贷款信托(Scottish Mortgage Investment Trust,下称SMT)的基金经理。

安德森出生于1959年,本科毕业于牛津大学历史系,后赴意大利和加拿大读研,1982年获得国际事务硕士学位。安德森于1983年加入Baillie Gifford,1987年成为合伙人,2000年开始管理SMT,20年间为股东带来了约1500%的回报。

安德森将于2022年4月30日从BG退休,所以这封信是安德森在BG的最后一封致投资人的信。

写了这么多年四平八稳的信之后,请允许我在这第22封也是最后一封信中直率一些。过去的20多年里我犯了很多错、做了很多误判,但是我越来越相信,我最大的失误是不够激进。坦率的说,传统投资管理的世界已不可挽回的破碎了。它需要新的思想,远远超过爱丽丝在梦游仙境中所说的“在早餐之前先想六件不可能发生的事情”。

一些信念

让我开头先讲一讲我所相信的理念。无需多言,我的继任者应该对未来的几十年中一直相信这些信念持怀疑态度。世界在变,我们也要变。现在确实是一个告别的合适的时点。投资的世界在20世纪80年代中期发生了深刻的变化。由价值投资教父本杰明•格雷厄姆(Ben Graham)所开创的、沃伦•巴菲特(Warren Buffett)所尊崇的和媒体所拥抱的价值投资理论,一点也不像爱丽丝的兔子洞(Alice 's rabbit hole),能够描述19世纪末的情况。为了说明格雷厄姆所定义的十年利润翻倍的成长股的世界发生了什么变化,让我们看一看最近的一些数据:

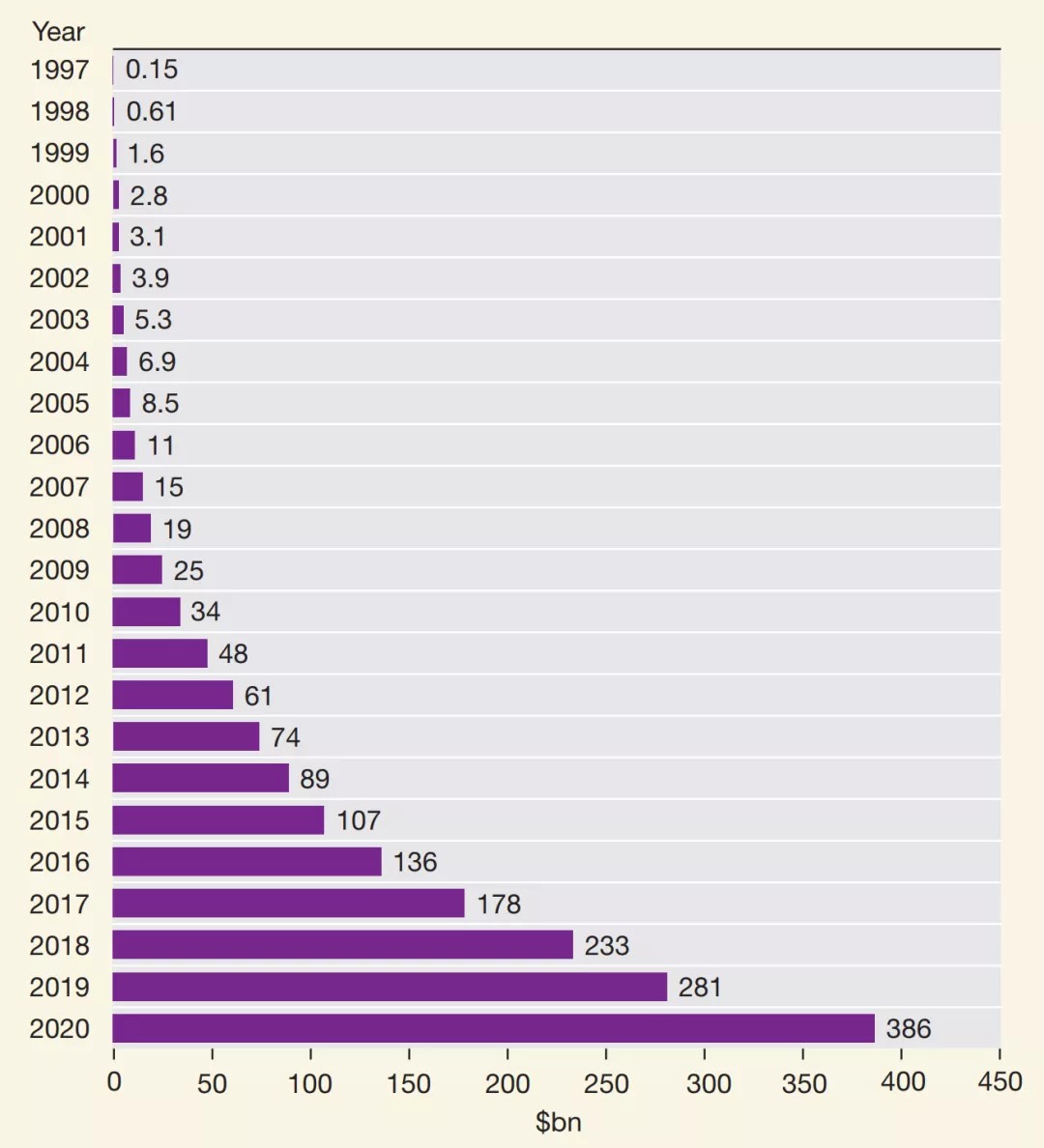

我相信你们很多人能够认出来,这是亚马逊(Amazon)的年度收入数字。这些数字还低估了亚马逊的成绩,因为第三方会计准则比较保守。亚马逊20多年的年复合增速高达41%。格雷厄姆等人更喜欢的自由现金流指标,在2020年也高达310亿美元。自从数字科技的出现,这种可持续的高速增长模式和规模效应越来越明显,最早的典型案例是微软(Microsoft),它在上市35年后仍然保持高增长。

投资的道理就存在于这些极端情况。CFA灌输给年轻人的是,沿着经典的钟形曲线(正态分布)你可以选择一个风险与收益的点来符合你的投资组合,但这并不现实,因为CFA既没有接受当今世界的高度不确定性,也不承认回报的极端分布意味着寻找具有极端和可持续增长特征的公司对于投资的核心意义。分心在平庸公司中寻找短期的微小机会是始终的诱惑。这种诱惑需要抵制。这需要强大信念。股价回撤是经常的和严重的,回撤40%是常态。股价走势图看起来就是从左下到右上的平滑上升,但是当你买入之后情况就不是如此了。

那我们如何识别这些有杰出潜力的股票呢?我们如何获得信念以使得复利魔法能够发挥作用呢?刚好贝索斯(Jeff Bezos)卸任亚马逊CEO,我们来回顾一下我们注意到什么、如何忍受波动、哪些地方没做好。

伟大的投资,通常具备以下特征:公司具有无限的增长机会,从不自我设限;由创始人来领导公司;具有鲜明的经营哲学,通常是从第一性原理出发而独创出来的。我认为这些特点在早期的亚马逊身上都是可以看得到的。读了贝索斯1997年致股东的信,就能知道他是兼具野心和耐心的具有独特思维的人。坦率的说,我们当初之所以没有认识到,不是因为没有线索,而是因为我们自身的局限性。我们对市场波动太熟了,太过于追求短期业绩,太过于看重回撤控制,很难成为坚定的持有者。直到2005-06年左右,我们的投资才没那么糟糕,能够认识到亚马逊的潜力,并且能够忍受各种波动与噪音的干扰。干扰是非常多的,例如:亚马逊股价在2006年从最高峰回撤46%;我渐渐习惯了,同行们在电话会议上宣称亚马逊是他们最喜欢做空的股票;他们特别不喜欢亚马逊Prime会员计划和服务计费两项业务的成本,服务计费后来变成了AWS云服务业务。我们逐渐学习和理解亚马逊,但是当亚马逊头寸超过我们的10%持仓限制时,我们多次被迫减仓。这一点我要道歉,我认为这种做法是有问题的。最近几个月我们对亚马逊的热情才稍微减了一点,亚马逊被认为是安全、可接受的价值投资标的,创始人也不再担任CEO了,虽然前路依然光明,但是我们担心,创业第一天的那种激情没有了。

时间框架,可能性,极度不确定性

着迷于长期投资决策的原因数不胜数,这里就不一一描述。但是有一个看起来似乎异常重要的推论被忽视了。有效市场理论认为,所有可得信息都包含在股价中了,只有新的信息才起作用。这被用来证明对企业盈利公告、宏观经济新闻等消息的追逐是合理的。反过来,追逐短期回报的力量又加强了这一点。

到目前为止,这是一个标准的批评。我们分享它,然后问题就来了。如果你相信所有信息都体现在股价中,同时又认为短期投资业绩至关重要,这就留下了一个思考的空白。没有明显的根据来解读未来。这听起来很抽象但其实不是。让我们以特斯拉为例来说明一下这个谜题。当我们7 年前第一次投资特斯拉时,我们认为,更确切地说是观察到,电池性能改进和电动汽车制造学习的规律和速度,在现实中很清楚了,在学术研究中也很好阐述了。从那时起,改进的速度和对数据的信心一直在上升。这使得在投资允许的情况下,必然在某一天,电动汽车将比内燃机具有更高性能和更便宜,更不用说更环保。当15%以上的进步速度面对2-3%的蜗牛速度时,超越就会发生。

既然特斯拉是西方世界唯一的大玩家,我们的投资决策就很简单明了。我们只需要聆听专家意见,然后等待。大部分投资者并不去听专家意见,而是听经纪人和媒体的话,被恐慌买卖和很多做空者所迷惑。新闻头条告诉他们,下季度特斯拉的日子将不好过,马斯克(Elon Musk)又口无遮拦。对我们而言,这是一种明显的市场失效,为有耐心的投资人提供了极高可能性的高回报。太多的投资决策是基于边际判断。电动汽车将胜出的可能性是越来越大的。我们不需要洞见,不需要聪明的模型来发现它,只需要耐心和对专家、对公司的信任。不确定性在别处,地理上的别处。考虑到中国市场的高度竞争,我们对蔚来汽车的投资能否大获成功或者能否存活,是完全不确定的。特斯拉的投资回报也要考虑中国市场,尤其是现在,尤其对于特斯拉的自动驾驶雄心。这将改变特斯拉的经济状况。尽管我们尽力去做,我们也不大可能预估出特斯拉在一个全新行业中胜出的可能性,也无法预估一旦胜出后现金流的精确结果。离奇的是,经纪商、对冲基金专家和评论人士都声称能够解读特斯拉的未来,并能给出一个精确的目标价。也许他们都是天才吧。我们不是。我们要尊重和接受不确定性,努力找出极端上行可能出现的地方,然后耐心的观察。

这不是增长VS价值

特斯拉只是当今时代投资的核心问题的一个例子,一个至关重要的例子。投资的核心问题,不是增长还是价值的取舍,不是市场估值水平的高低,也不是2021年的经济增速或新冠疫情的进展,而是理解变化、变化怎么发生的、发生了多少以及他们的影响。拒绝接受这一点,反映了对安全的超级渴望,也象征着被数学均衡所占据的经济思想出现了广泛的危机。如果我们把注意力转移去研究深刻的变化,那么就没那么会相信投资有永恒的真理让我们默认为规则。危险的呼声不是“这次不同了”,而是拒绝承认这个世界,以及作为其反映的投资,和以前不一样了。唯一还有效的规律是,股票的长期价值取决于其长期产生的自由现金流。但是对于这些现金流将会是多少,我们只有最少的和最模糊的线索。在一个深刻变化的年代,还拿着短期PE倍数来判断估值的人,将难免吃灰。

未来

未来的10年,将肯定出现比我们所见过的更加激荡、更鼓舞人心、更巨大的变化。我很羡慕我的继任者们所享有的机会和经历。即使在新冠疫情悲剧蔓延的2020年,已经有很多迹象显示新事物的到来。我指的不是为了克服疫情限制所出现的大量数字平台,而是更激动人心、更加重要的新生力量。让我们的社会变得更好的可再生能源取得非凡成就,逐渐成为主流;合成生物学出现了可喜的成绩,使得医疗创新成为一系列有益人类的成果,而不是复杂的和令人沮丧的资源消耗。未来无限美好,对旧帝国的威胁迫在眉睫。如果不是参与了风险投资(VC),我们很难在这些领域培养巨大的热情。我们永远感激我们找到了在一级市场与那些具有非凡思想和能量的人互动。坦率的说,五年前我会对如今习以为常的接触和机会感到惊讶。我们很幸运。这是一种荣幸。我们的前董事会成员,约翰•凯(John Kay),教给我们很多东西,但其中最有价值的是迂回的作用。通过与富有远见的企业家和他们的公司打交道,我们寻求对于未来的洞察。通常我们是不知所措的、困惑的,而不是理解的。这就是我们的计划。投资的结果只是思想和努力过程的最终结果。

我们需要保持古怪。事实上我们需要变得更加古怪,更加激进。我们一直声称,在管理SMT时,我们要向有幸遇到的杰出的领导者们学习。如果可以的话,我想引用其中的两位作为结尾。第一位是旗舰医疗投资公司创始人、Moderna董事长的Noubar Afeyan。一年前的此时此刻,我可能需要详细说明Moderna的使命,但如今这是多余的了。我想引用的评价远远超出了Moderna和疫苗的范围:

“让我说一些直白的话……为了取得非凡的发现,我们必须愿意拥抱不合理的建议和不合理的人,因为完全合理的人做完全合理的事能够产生巨大的突破我是不相信的”。

没有哪个行业比资产管理行业更加质疑非传统想法。我们需要从第一性原理出发重新构建新理念。我们需要帮助创建拥抱非凡的伟大公司。显然,没有任何其他人比贝索斯能更好的展示和阐释这一点。他在最近的、很遗憾也是最后的一封CEO信的结尾写道:

“我们都知道独特性--独创性,是宝贵的。我真正要求你做的是接受并现实的看待保持独特性有多难!这个世界希望你是普通平常的,它有一千种方式驱使你这么做。不要让它发生”。

我不认为汤姆(Tom)和劳伦斯(Laurence)需要这个建议,也不认为他们俩会忽略贝索斯先生的观点。但是请帮助SMT变得更不合常规、更加独特,因为投资界的压力持续的拉扯着我们。

詹姆斯•安德森

2021年5月12日

Managers' Review

After many years of anodyne reviews perhaps some bluntness is permissible in this final and twenty second version. There’s much that I have misunderstood and misjudged over the two decades but my ever-growing convictionis that my greatest failing has been to be insufficiently radical. To be blunt:the world of conventional investment management is irretrievably broken. It demands far in excess of the canonical ‘six impossible things before breakfast’ that Alice in Wonderland propounds.

Some Contentions

But let me start by trying to set out what I do believe. Hopefully it doesn’t need saying that my successors should be suspicious of continuing to believe in these contentions for the next decades. As the world changes so should we. Indeed this is an appropriate point of departure. The investment world changed profoundly in the mid 1980’s. It resembles that most famously described by Ben Graham, the apostle of value investing, paid homage to by Warren Buffett and perpetually embraced by the media, as little as Alice’s rabbit hole described the reality of the late 19th century. To illustrate the change from the world in which a growth stock was defined by Graham as one able to double earnings in a single decade let’s look at some more recent figures:

I’m sure that many of you will recognise these numbers as the annual revenues of Amazon. They rather understate progress as the accounting for third-party fulfilment is conservative. But we still have a compound growth rate of 41% per annum for over two decades. For those, like Graham, who prefer the-bottom line then 2020 produced $31bn in free cash flow. This pattern of sustained growth at extreme pace and with increasing returns to scale has become more and more evident since the emergence of digital technologies as first exemplified by Microsoft (still growing after 35 years as a public company).

It is in these extremes that investing resides. Despite what the CFA foists on the young and innocent you cannot choose a level of risk and return along a classic bell-curve to suit your portfolio because that is neither accepting the deep uncertainty of the world nor acknowledging that the skew of returns is so extreme that it is the search for companies with the characteristics that might enable extreme and compounding success that is central to investing. But distraction through seeking minor opportunities in banal companies over short periods is the perennial temptation. It must be resisted. This requires conviction. The share price drawdowns will be regular and severe. 40% is common. The stock charts that look like remorseless bottom left to top right graphs are never as smooth and easy as they subsequently appear.

So how do we identify these stocks with extraordinary potential? How do we acquire the conviction to allow the compounding to work its magic? As Jeff Bezos steps down as CEO let’s look back at what we spotted, how we endured and what we failed to do for shareholders. The common factors that are most likely to recur in the narratives of great investments are that the company should have open-ended growth opportunities that they should work hard never to define or time, that it has initial leadership that thinks like a founder (and almost always is one)and that has a distinctive philosophy of business – almost always from independently thought through first principles. Now, I think that all these traits were identifiable in Amazon from the start. To read the initial shareholder letter of 1997 was to know that this was the ambitious, patient creation of a very special mind. To be frank our failure to recognise this was because of our own limitations not an absence of clues. We were simply too aware of market movements and too preoccupied with the terrible combination of short-term performance and fear of downside to be able to be committed owners.By 2005–6 we were less bad investors and could recognise some of the potential and endure more of the slings and arrows. Of those there were plenty: the share price fell 46% from peak to trough in 2006. I became used to peers at client conferences declaring Amazon their favourite short. They particularly disliked the costs of two projects – Prime and Amazon Elastic Compute. The latter became AWS. Gradually we learnt and understood. But we should apologise for our willingness to trim Amazon back repeatedly when our holding size approached 10% of assets.That was misguided. Only in recent months has our enthusiasm waned. Amazon is now seen as good value, safe and acceptable. It no longer has a founder CEO. We fear that in his inimitable terms it is no longer Day 1 in Seattle though the road ahead is still long and profitable.

TimeFrames, Likelihoods and Radical Uncertainty

The litany of reasons to be obsessed with long-term decision making is too long to describe here. But there’s an offshoot of it that seems unusually important yet neglected. It is inherent to the notion of efficient markets that all available information is incorporated in share prices. Only new information matters. This is used to justify the near pornographic allure of news such as earnings announcements and macroeconomic headlines. In turn this is reinforced by the power of near-term financial incentives.

So far this is a standard critique. We share it but there is a twist to come. If you believe that all information is built into the share price and simultaneously that it is near term investment outcomes that matter this leaves a vacuum of thought. There is no apparent rationale for deciphering the future.If this sounds abstract it’s not so. Let’s take a look at Tesla to illustrate the puzzle. When we first invested in the company seven years ago we thought,or rather observed, that the regularity and pace of improvement in battery performance and of learning in building electric vehicles was already clear in practice and well-elucidated in academic study. Since then both the pace of improvement and the level of confidence surrounding the data has risen consistently. This made it as close to inevitable as investing allows that at some point electric vehicles were going to be better and cheaper than the internal combustion engine – quite aside from environmental issues. That’s simply what happens when a 15% plus improvement rate meets a 2–3% snail.

Since Tesla was the only substantial Western player our investment decision was hardly demanding. We just had to listen to experts and wait. But most investors do not listen to experts. Instead they listen to brokers and the media, besotted as it is by fear mongering and the many short sellers. The headlines tell them that next quarter will be hard for Tesla and that Elon Musk is outspoken. To us this was a blatant market inefficiency offering an extraordinarily high likelihood of high returns to the patient. All too many investment decisions are marginal judgments. That electric vehicles would win had become intensely likely. We needed no insight, no clever model to spot it –only patience and trust in experts and the company. The uncertainty was elsewhere. It was elsewhere geographically – given the levels of competition in China it was profoundly uncertain that our investment in NIO would flourish or even survive. It was elsewhere in return calculations for Tesla itself. This particularly applies now and to Tesla’s autonomous driving ambitions. This could transform the economics of the company. But try though we do it seems implausible that we can estimate either the likelihood of success in a radically new endeavour nor the precise outcomes in cashflows should success emerge. To us it is bizarre that brokers, hedge fund mavens and commentators can claim to be able to decipher the future and assign a precise numerical target to the value of Tesla. Perhaps they are all geniuses. We are not. We should respect and endure uncertainty, try to identify where extreme upside might occur and observe patiently.

It’s Not Growth versus Value

Tesla is but an example, if a crucial one, of the central issue for investing in our times. It isn’t growth versus value, it isn’t the level of markets, it isn’t the economic growth rate in 2021 or the progress of the pandemic but it is understanding change, how it happens, how much happens and its implications. The refusal to embrace this is probably a reflection of the doomed desire for security but it is also emblematic of abroader crisis in economic thought that is preoccupied with the mathematics of equilibrium. But If we switch our attention to studying deep change then there is less temptation to believe that investing has eternal verities that we can default to as a rule book. It’s not ‘this time it’s different’ that is the cry of danger but the refusal to admit that the world, and its reflection that is investing, is ever the same. The only rhyme is that in the long run the value of stocks is the long-run free cash flows they generate but we have but the barest and most nebulous clues as to what these cash flows will turn out to be.But woe betide those who think that a near term price to earnings ratio defines value in an era of deep change.

The Future

There will almost certainly be more wrenching, inspiring and dramatic change in the next decade than we have ever seen. I’m very envious of the opportunities and experiences that my successors will enjoy. Even in the last year, amidst the tragedies of the pandemic, there have been hints of what is to come. I don’t mean the surge in digital platforms that helped to navigate the constraints of the pandemic but still more dramatic and important rising forces. From the extraordinary revolution that will transform our societies for the better in renewable energy becoming mainstream to the emerging wonders of synthetic biology to the possibility that healthcare innovation becomes a regular series of beneficial revolutions rather than a complex and frustrating drain of resources the potential is wonderful and the threat to old empires looms. It would have been hard for us to have educated ourselves in these areas of unashamed excitement without our involvement in venture capital. We are forever grateful that we have found our way to interact with the extraordinary minds and energies in the unquoted world. Frankly, five years ago I would have been amazed at the access and opportunities that we have come to take as normal. We are very fortunate. It’s a privilege. Our former Board member, John Kay, taught us many things but one of the most valuable was the role of obliquity. By engaging with visionary minds and their companies we are simply seeking insight into the world of tomorrow. Often we are overwhelmed and puzzled more than comprehending. That’s the plan. The investment outcomes are but the eventual outcomes of the mentality and process.

We need to remain eccentric. In fact we need to become more so and more prepared to be radical. We’ve always claimed to learn from the remarkable leaders we are lucky enough to meet in managing Scottish Mortgage. If I may I’d like to end by quoting two of them. The first is Noubar Afeyan, founder of Flagship health investors but also Chair of Moderna. A year ago I would at this point have needed to detail the purpose of Moderna but that is now delightfully redundant. But the comment I want to quote applies far beyond Moderna and vaccines:

“Let me say maybe something stark…which is that we have to be willing to embrace unreasonable propositions and unreasonable people in order to make extraordinary findings because the notion that utterly reasonable people doing utterly reasonable things will produce massive breakthroughs doesn’t compute to me”.

There is no industry more suspicious of the unconventional than fund management. We need to reinvent from first principles. We need to help create great companies that embrace the extraordinary. Plainly no one has been better at demonstrating and articulating this than Jeff Bezos. His recent, and sadly last, CEO letter concluded with a plea:

“We all know that distinctiveness – originality – is valuable…What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness. The world wants you to be typical – in a thousand ways, it pulls at you. Don’t let it happen”.

I don’t think Tom and Lawrence need this advice, or would neglect the views of Mr Bezos. But please help Scottish Mortgage become more unreasonable and more distinctive as the pressures of the investment world continue to pull at us.

James Anderson

本文为专栏作者授权创业邦发表,版权归原作者所有。文章系作者个人观点,不代表创业邦立场,转载请联系原作者。如有任何疑问,请联系editor@cyzone.cn。